I used to think traveling the world was reserved for trust fund kids and Instagram influencers with mysterious income sources. You know the type—posting sunset photos from Santorini while casually mentioning their “minimalist lifestyle” (spoiler alert: their minimalism costs more than my annual salary).

But here’s the thing I discovered after accidentally booking a flight to Prague instead of Dublin (long story involving too much wine and similar-looking airport codes): the best travel experiences often come from the scrappiest moments, not the most expensive ones.

After three years of nomadic wandering on what I generously call a “creative budget,” I’ve cracked the code on making wanderlust financially sustainable. These aren’t your typical “skip the daily latte” tips—though honestly, airport coffee prices should be classified as highway robbery.

The Great Expense Audit: Where Your Money Really Goes

Before we dive into the good stuff, let’s talk about the elephant in the room. Most people have no clue where their money disappears to each month. I certainly didn’t until I started tracking every expense for 30 days and realized I was spending $127 monthly on subscription services I’d forgotten existed.

Insert image of expense tracking spreadsheet chaos here

The average American spends roughly $3,500 annually on dining out alone. That’s a solid two weeks in Southeast Asia, flights included. But I’m not here to shame your weekend brunch habits—I’m here to help you fund your escape plans.

1. Master the Art of House Hacking

This one changed everything for me. Instead of paying rent like a sucker, I started house-sitting through platforms like TrustedHousesitters and Nomador. Picture this: free accommodation in exchange for watering plants and giving golden retrievers belly rubs.

Last summer, I spent six weeks in a converted barn in Tuscany, complete with a vegetable garden and a wine cellar the owners insisted I “sample for quality control.” My accommodation cost? Zero dollars. My liver’s recovery time? That’s another story.

2. Become a Subscription Assassin

Remember that expense audit? Time to channel your inner Marie Kondo and ask each subscription if it sparks joy—or if it’s just sparking monthly withdrawals. Cancel everything you don’t actively use weekly.

I discovered I was paying for:

- Three different music streaming services

- A meditation app I’d used twice

- Amazon Prime (kept this one, obviously)

- A gym membership for a gym that had closed six months prior

Monthly savings: $89. Annual savings: $1,068. That’s enough for a month in Vietnam, including that cooking class in Hoi An I’ve been eyeing.

3. The Grocery Game Revolution

Meal planning isn’t sexy, but neither is being broke in Barcelona. I started batch cooking on Sundays—think of it as Netflix and meal prep, minus the existential dread of another true crime documentary.

Buy generic brands, shop seasonal produce, and embrace the freezer as your best friend. My grocery bill dropped from $400 to $180 monthly just by cooking at home four more nights per week.

4. Transportation Transformation

Selling my car was terrifying and liberating in equal measure. Between insurance, gas, maintenance, and parking in my urban hellscape, I was hemorrhaging $650 monthly for the privilege of sitting in traffic.

Now I bike, walk, use public transport, and occasionally splurge on rideshares. Monthly transportation cost: $87. The bonus? I accidentally got into the best shape of my life and discovered podcasts.

5. The Side Hustle Strategy

I’m not talking about becoming an MLM hun or selling your grandmother’s antique collection (though if Grandma had good taste…). Find something you’re decent at and monetize it.

I started freelance writing, dog walking on weekends, and selling my photography prints on Etsy. Nothing groundbreaking, but an extra $800 monthly adds up to serious wanderlust fuel.

6. Credit Card Point Hacking (The Legal Kind)

This requires discipline, but if you can handle it, travel credit cards are magical. I’m talking free flights, hotel stays, and lounge access that makes you feel temporarily important.

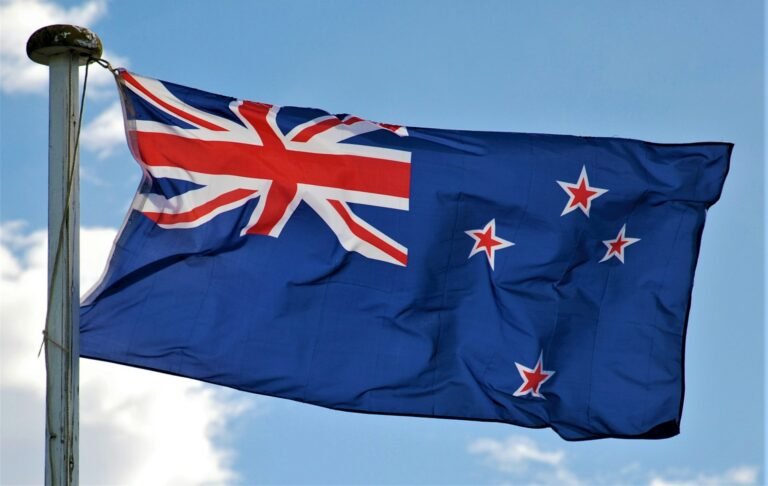

The trick: use the card for expenses you’d have anyway, pay it off immediately, and never carry a balance. I earned enough points last year for a round-trip ticket to New Zealand just by putting my regular expenses on the right plastic.

7. Embrace the Sharing Economy

Rent out everything: your parking space, spare room, car, bike, even your lawn for events. I made $200 last month letting a photographer use my apartment’s exposed brick wall as a backdrop. Apparently, my terrible decorating choices are “authentically urban.”

Platforms like Airbnb, Turo, and Fat Llama turn your possessions into profit centers. Just maybe hide your embarrassing collection of romance novels first.

8. The Great Downsize

Marie Kondo was onto something, even if her folding techniques seem designed by origami masters. Sell everything that doesn’t fit in two suitcases (or whatever your travel vision requires).

I made $3,200 selling furniture, clothes, kitchen gadgets, and books. Turns out, I owned fourteen coffee mugs for a household of one. The math didn’t add up, but the profit did.

Insert image of decluttered minimalist space here

9. Energy Efficiency = More Adventure Money

Small changes, big impact. LED bulbs, programmable thermostats, draft stoppers—boring stuff that saves exciting money. My utility bills dropped by 30% with minimal effort and maximum smugness about my carbon footprint.

10. Insurance Optimization

Shop around annually for everything: car, health, renters, life insurance. I saved $400 yearly by switching car insurance and another $600 on health insurance by choosing a slightly higher deductible plan.

Boring? Absolutely. Worth it? That $1,000 savings funded my entire month in Morocco, including that questionable but delicious street food in Marrakech.

11. The Bank Fee Assassination

Banks love charging fees for breathing in their general direction. Switch to credit unions or online banks with no monthly fees, free ATM access, and higher interest rates on savings.

I saved $180 annually just by switching banks. Not life-changing money, but enough for several excellent meals in Bangkok.

12. Master the Art of Free Entertainment

Museums have free days, cities host free concerts, hiking costs nothing but energy. I spent last Saturday at a free wine tasting (they were promoting a new vineyard), followed by a free outdoor movie screening.

Total cost: $0. Entertainment value: priceless. Hangover the next morning: moderate but manageable.

13. The Bulk Buying Strategy

Buy non-perishables in bulk: toiletries, cleaning supplies, anything with a long shelf life. The upfront cost stings, but the monthly savings add up.

I spent $200 at Costco and didn’t buy shampoo, toothpaste, or paper towels for eight months. My bathroom looked like a small pharmacy, but my bank account appreciated the efficiency.

14. Negotiate Everything

Call your internet provider, phone company, insurance companies—everyone. Ask for discounts, loyalty rates, competitor matching. The worst they can say is no, but you’d be surprised how often they say yes.

I reduced my phone bill by $25 monthly just by asking nicely and mentioning a competitor’s offer. That’s $300 annually for a ten-minute phone call.

15. The Emergency Fund Mindset Shift

Instead of an “emergency fund,” create a “freedom fund.” It’s the same money, but the psychological shift is powerful. You’re not saving for disasters—you’re saving for adventures.

Automate transfers to this account. Even $50 monthly grows into $600 annually, enough for a week in Prague (and hopefully better navigation skills than my wine-influenced booking disaster).

The Reality Check: Making It Sustainable

Here’s the truth nobody talks about: extreme frugality isn’t sustainable long-term. I tried living on beans and rice for two months and nearly had a nervous breakdown in the grocery store cereal aisle.

The goal isn’t to become a financial monk—it’s to be intentional about spending. Cut ruthlessly on things that don’t matter to you, but maintain some quality of life. I still buy good coffee and occasionally splurge on dinners out with friends.

The difference? Now I choose consciously instead of spending mindlessly.

When Things Go Wrong (And They Will)

Let me tell you about the time I tried to save money by booking the cheapest possible flight to Bangkok. Three layovers, 27 hours of travel time, and I arrived looking like I’d been attacked by airport security. Sometimes the cheapest option isn’t the smartest option.

Budget travel is about smart spending, not just cheap spending. Factor in your time, energy, and sanity when making decisions.

The Compound Effect in Action

Small changes create massive results over time. Here’s what implementing these strategies looks like annually:

| Expense Category | Monthly Savings | Annual Savings |

| Subscriptions | $89 | $1,068 |

| Groceries | $220 | $2,640 |

| Transportation | $563 | $6,756 |

| Insurance | $83 | $996 |

| Bank Fees | $15 | $180 |

| Total | $970 | $11,640 |

That’s enough for three months in Southeast Asia, a month in Europe, or a solid adventure through South America. Not bad for some lifestyle adjustments that became habits within six weeks.

Your Next Steps (AKA Stop Reading, Start Doing)

Pick three strategies from this list and implement them this week. Not next month, not after the holidays—this week. I suggest starting with the subscription audit (immediate gratification), the grocery game (weekly savings), and negotiating one bill (because everyone deserves a quick win).

Track your progress, celebrate small victories, and remember why you’re doing this. Whether it’s trekking through Patagonia, learning to cook pad thai in Bangkok, or simply having the financial freedom to take opportunities as they come, every dollar saved is a step toward your version of freedom.

The world is expensive, but it doesn’t have to be prohibitively so. Sometimes the best adventures come from the most resourceful planning.

Frequently Asked Questions

How much money do I need to start traveling long-term?

Most budget travelers recommend having at least $5,000-10,000 saved before embarking on extended travel, though you can travel shorter-term with less. This covers initial flights, emergency funds, and several months of budget travel expenses.

What are the cheapest countries to visit for budget travelers?

Southeast Asia (Thailand, Vietnam, Cambodia), parts of Eastern Europe (Poland, Czech Republic, Hungary), Central America (Guatemala, Nicaragua), and India offer excellent value for money with daily budgets under $30-50.

How can I travel without quitting my job?

Consider remote work arrangements, freelancing, using vacation days strategically, sabbaticals, or seasonal work that allows extended time off. Many professionals negotiate remote work periods with employers.

Is it safe to travel on a tight budget?

Budget travel can be safe with proper planning. Stay in reputable hostels, research neighborhoods, have emergency funds, maintain travel insurance, and trust your instincts. Don’t compromise on safety to save money.

What’s the best way to find cheap flights?

Use flight comparison sites, be flexible with dates and destinations, consider budget airlines, book in advance (but not too far), and set up price alerts. Tuesday and Wednesday flights are often cheaper.

How do I handle money and banking while traveling?

Use banks with no foreign transaction fees, notify banks of travel plans, carry backup cards, use ATMs instead of currency exchange, and consider travel-friendly online banks like Charles Schwab or Capital One.

What should I pack for budget travel?

Pack light with versatile clothing, quick-dry fabrics, a good backpack, travel-sized toiletries, first aid kit, universal adapter, and entertainment for long transport days. Less stuff means lower baggage fees and easier mobility.

How can I eat well on a travel budget?

Shop at local markets, cook your own meals when possible, eat street food (safely), look for lunch specials, avoid tourist restaurants, and embrace local cuisine which is usually cheaper than Western food abroad.

What’s the difference between backpacking and budget travel?

Backpacking typically involves carrying everything in a backpack and staying in hostels, while budget travel is simply traveling economically regardless of accommodation type or luggage choice. Both prioritize experiences over luxury.

How do I stay connected without expensive roaming charges?

Buy local SIM cards, use WiFi whenever possible, download offline maps and translation apps, consider international phone plans, or use apps like WhatsApp and Skype for communication.

Top Products and Travel Recommendations

Budget Travel Gear:

- Osprey Farpoint 40 Travel Backpack – Osprey Official – Perfect carry-on sized backpack that opens like a suitcase

- Anker Portable Charger – Amazon – Essential for long travel days and areas with unreliable power

Accommodation Platforms: 3. Hostelworld – Hostelworld.com – Best platform for finding and booking budget accommodations worldwide 4. Airbnb – Airbnb.com – Great for longer stays and apartment rentals in expensive cities

Transportation: 5. Skyscanner – Skyscanner.com – Comprehensive flight search engine with flexible date options 6. Rome2Rio – Rome2rio.com – Shows all transportation options between destinations including buses and trains

Money Management: 7. Charles Schwab Debit Card – Schwab.com – No foreign transaction fees and ATM fee reimbursements worldwide 8. Revolut Travel Card – Revolut.com – Multi-currency card with excellent exchange rates

Food and Local Experiences: 9. Rome2Rio – EatWith.com – Authentic local dining experiences with families and locals 10. Too Good To Go App – TooGoodToGo.com – Discounted food from restaurants and cafes in many cities

Budget Destinations: 11. Vietnam – Vietnam Tourism – Incredible food, culture, and value with daily budgets under $25 12. Portugal – Visit Portugal – Western Europe on a budget with stunning coastlines and historic cities 13. Guatemala – Visit Guatemala – Rich Mayan culture, volcanos, and very affordable travel costs 14. Poland – Poland Travel – Beautiful medieval cities, great food, and excellent value in Eastern Europe

Travel Insurance: 15. World Nomads – WorldNomads.com – Flexible travel insurance designed for adventurous travelers 16. SafetyWing – SafetyWing.com – Affordable monthly travel insurance perfect for digital nomads

Learning and Planning: 17. Nomadic List – NomadList.com – Community and data about the best cities for digital nomads and budget travelers 18. Budget Your Trip – BudgetYourTrip.com – Detailed cost breakdowns for destinations worldwide

Communication: 19. Google Translate App – [Google Play/App Store] – Essential offline translation tool with camera function 20. Maps.Me – Maps.Me – Detailed offline maps that work without internet connection